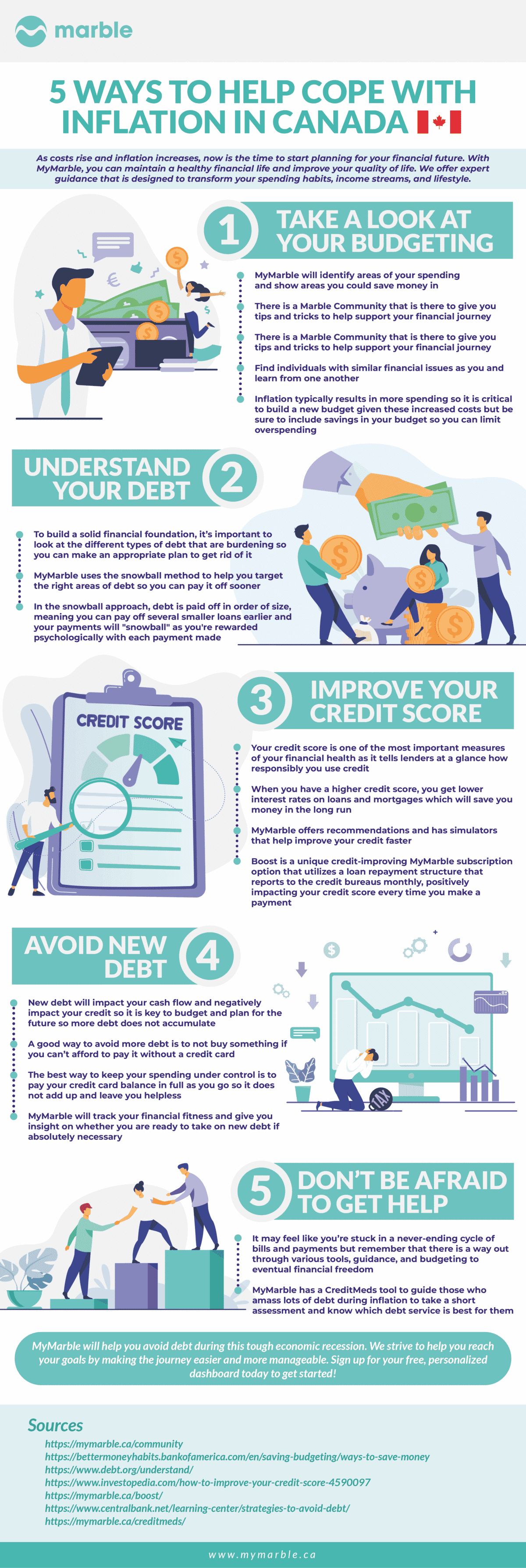

Did you know that the Bank of Canada recently raised its policy interest rate from 1.0% to 1.5% in the hopes of fending off inflation? They did this so inflation will stay low at or around 2%, but this could also plunge the economy into a recession, concerned economists said.

If you are a professional or business person living in Canada and are looking to protect your credit score from falling during a possible recession, then you are in the right place. In the article below, we will inform you how to improve your credit score (or keep it steady) even if there’s a recession buzzing around.

Monitor Your Credit

One of the first ways you can ensure your credit score doesn’t go down during a recession is to monitor it like a hawk. There are many services like Marble, which can help you check your credit score in Canada.

The problem is that too many Canadians have no idea what their credit score is and don’t check their credit scores regularly enough to know when it changes. Remember that your credit score is not a fixed number, but it fluctuates from month to month depending on your financial habits.

For example, two people could have a score of 700 right now, but one of them could have had a score of 500 a few months back, whereas, the second person had a score of 800 a few weeks ago. This shows you that even though both of these people are at the same score right now, they started from very different places.

The 5 things that affect your credit score are:

- Payment history (35% of your credit score)

- Amounts you owe (30%)

- Length of credit history (15%

- New credit you apply for (10%)

- Types of credit you use (10%)

There are a lot of things that can affect your credit score, but this also means that you have a lot of control over it. If you keep checking your credit score, you can know instantly when there’s something wrong and you can start working to rectify the problem right away.

Are you wondering, what is a good credit score in Canada? According to Equifax, a good credit score in Canada is between 660 and 724. The credit score range in Canada is between 300 to 900.

Pay Off Your Debt

There are some debts, like your mortgage, that are considered to be ‘good debts.’ And there are others like your credit card debt or a car loan, that are considered to be ‘bad debts’.

The idea here is that your mortgage is based on a solid asset, that is, your home. That’s why it’s a good debt that helps increase your net worth over time. Also, mortgage interest rates have been so low recently that Canadians are happy to take on this debt in their financial portfolio.

But your credit card debt is another story altogether. Not only are the interest rates on your credit cards horrendously high, but they are also not building your asset base or net worth in any way.

This doesn’t mean that you need to cut up all your credit cards and start living like an ascetic. But it does mean that you need to be a bit more discerning when piling on credit card debt. If you’re unsure about how to pay off the current debt you have, try out our free and no obligation credit assessment tool today!

Don’t Spend Unconsciously

Think twice before putting something on your credit card. Ask yourself some questions, like:

- Do you need this item or can you wait until you have the cash for it?

- Could you get this item by other means, for example by visiting a thrift store or borrowing it?

20% of Canadians are looking to lessen their reliance on credit cards in 2022. This could be a really good idea for you to try out as well.

Make cash the primary way in which you purchase items, but don’t forsake your credit cards entirely. They are a great way to build your credit score, but only if used responsibly.

You can use CreditMeds to get your debt under control. Start paying off your debt using any leftover income, and also, pay off all credit card purchases in full every month so you aren’t paying exorbitant amounts in interest charges.

Build an Emergency Fund

More than half of the Canadians surveyed said that they are $200 away from financial insolvency, that is, they are $200 away from not being able to pay all their financial obligations at the end of each month. This might or might not surprise you, depending on which side of the equation you fall on.

If you don’t have a cushion built into your finances each month, then it’s time to start building one. This is even more important if you are living in an inflationary Canada, because everything is going to be that much more expensive, and you are going to find catching up with your bills that much harder.

What is an emergency fund? It’s recommended that you save up at least 3-6 months of your monthly income in a separate account, and you don’t touch it or use it until you have a real financial emergency. If that means that you never touch it, so be it.

This emergency fund is meant to give you a bit of mental and financial relief. With this fund in place, you can rest assured that no matter what happens in the outside world, you have respite for a few months.

Imagine the recession hit Canada and you lost your job. If you didn’t have an emergency fund in place, you would be declaring bankruptcy in a few days, rather than having a bit of time to search for a job and still be financially solvent.

Remember that you must replenish your emergency fund every time you dip into it and it’s not a fun fund, which you can use to buy sneakers, purses, or vacations. The emergency fund is to be used only in financial emergencies, and for nothing else.

Contact Your Lenders To Lower Interest Rates

Lenders in Canada aren’t the Scrooge-style villains portrayed in Hollywood movies. They are quite amenable. But you have to have to speak to them before you start missing payments or skipping out on bills.

If you know that your monthly budget is getting tight and you could use some help in this regard, your first stop should always be your lenders. Whatever loans you might have, be it mortgages, car loans, student loans, or credit cards, speak to each lender one by one.

Tell them honestly about your situation and ask them if they could help you out by lowering the interest rates for a few months until you can get back on your feet. If you have been a great borrower and haven’t missed any payments for a while, they are likely to act favourably towards you and lower your interest rate.

The problem is that most Canadians don’t think that’s even a possibility so they never ask. But you never know! Wouldn’t it be so helpful to your budget, if you could get your interest rate lowered?

Stick to a Budget

Do you know what you spend your money on each month? Where does it all go, you might lament every month? But have you ever checked to see where it all goes?

The first step in building a budget is to take a couple of weeks, without changing your spending habits, and figure out where your money is going. Write down everything you spend every day into a notes app on your phone.

Tally it up every week and in a couple of weeks, you should have a pretty clear idea of how much money you are spending in each category. Once you have this step done, then it’s time for the ‘b’ word. Yes, we are talking about a budget.

You need to figure out how much you want to ideally spend in each category and then create a budget that restricts you from spending more. This is important because budgeting will ensure you don’t overspend each month and you don’t resort to credit cards to subsidize your income.

It will also teach you to stay within your limits and not go overboard because “you only live once” or “you are stressed out and want to pamper yourself.”

Ready, Set, Go – How To Improve Your Credit Score

Here you have it – five easy tips on how to improve your credit score straight from the horse’s mouth. Now you need to put these tips into motion by applying them to your finances.

Don’t get stressed and try to do it all at once. Take it bit by bit, and you will get there in no time.

If you wish for help in improving your credit score, then check out Boost by Marble. We utilize a loan repayment structure that reports every month to the credit bureau to improve your credit score in Canada every time you make a payment.