There’s nothing worse than checking your credit score to realize it dropped since the last time you checked. But don’t worry, once you’re able to quickly identify the reasons why your credit score dropped, the better. Then, you can work towards improving your credit score as fast as possible.

So maybe you logged on to your MyMarble Dashboard and noticed your credit score dropped since you last checked it. Well, credit scores are calculated using many different factors. And if there has been a change in your credit financial habits, you may have recently noticed a credit score drop. This may include closing accounts, a change in your credit mix, or applying for new credit. Let’s look at six reasons your credit score might have dropped and the steps to take to improve your credit score!

Five reasons why your credit score dropped

- A late or missed payment

- You applied for new credit

- A change in your credit utilization rate

- You closed a credit card account

- You paid off a loan

- There’s an error on your credit report

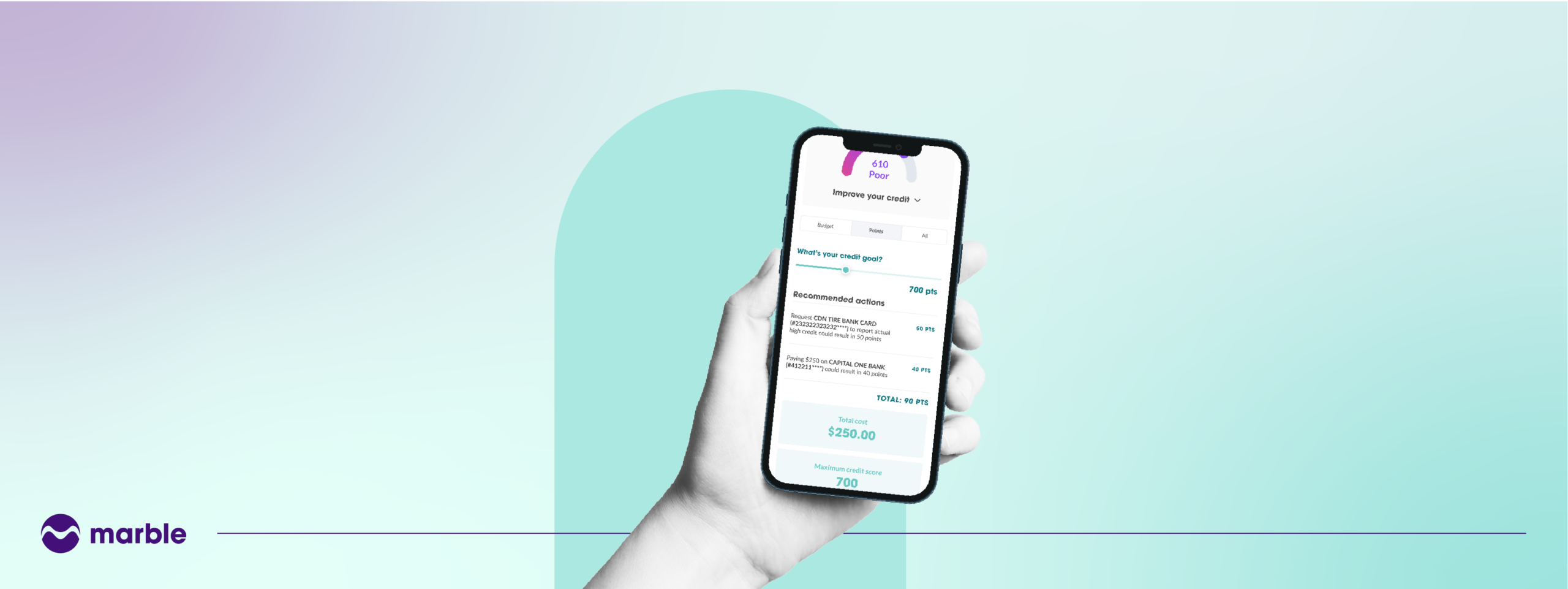

Want to improve your credit score fast? Sign-up for MyMarble Premium HERE to begin receiving personalized recommendations!

-

A late or missed payment

Payment history is an important factor that contributes to your credit score. When your credit report is being analyzed, it amounts to about 35% of your total credit score. But why? Well, lenders like to see that you can make your payments on time. Missing or making consistent late payments will damage your score and indicate to lenders that you’re at risk of non-payment.

But don’t worry, if you were only a few days late on a payment, it’s not likely to show up on your credit report. Any payment made later than 30 days past the due date is very likely to damage your score. And the later you leave the payment, the more damage to your credit score.

-

You applied for new credit

Every time you apply for a credit card or loan, your potential lender will need access to your credit report. This is called a hard credit pull. Regardless of whether you are approved or denied a loan or credit product, this will negatively impact your score. So, if you’re wondering why your credit score dropped recently, maybe you have applied for multiple lines of credit.

To help avoid a negative impact on your credit score, try to always check the approval criteria before applying for a product. In addition, only apply for a loan or credit card when you need it. By being more conscious of your credit applications, you can avoid an unexpected drop in your score.

-

A change in your credit utilization rate

Your credit utilization rate means how much of your total available credit you have used. For example, you have two credit cards with a total credit limit of $2500. If you maxed out both cards, your credit utilization rate would be 100%.But why does this matter? Well, your lender prefers you to not over-utilize your credit cards. Often, it’s recommended to not use any more than 30% of your available credit. So, in this case, if your credit limit was $2500, it’s more favourable to spend no more than $750. If you have utilized more than 30%, you may notice a drop in your credit score. Lenders penalized you for overutilizing your credit as this may imply that you’re not managing your money and are at risk of non-payment on a future loan or credit product.

-

You closed a credit card account

When your credit score is calculated, your length of credit history is considered. So, let’s say you’ve had a credit card account for 5+ years that you no longer use, and you decided to close it. Well, this credit card was contributing to your length of credit history which amounts to about 35% of your score.

Once this account is closed, your credit history is shortened on your credit report. Then, you may see a sudden drop in your credit score. If possible, try to keep your older credit card accounts open as long as they aren’t charging expensive monthly fees.

-

You paid off a loan

Hold on a second – how does paying something off cause your credit scores to drop? While unfortunately, it does make sense. Basically, paying off a loan may negatively impact your credit scores as it alters your credit mix. Having a good mix of revolving credit and installment loans is good for your credit score. So once you pay off a loan, your mix is reduced which then reduces your scores.

But don’t worry, you should still try to pay off your loans regardless. There are many ways you can improve your credit score such as through your MyMarble Premium account.

-

There’s an error on your credit report

We often just assume that all the information on our credit reports is correct. But lenders can make reporting mistakes. For example, if your address is incorrect or there’s a reporting error, your credit score may have dropped unexpectedly. If you find an error or mistake on your credit report, you can easily contact TransUnion and Equifax to have the error rectified. You can find out how to do that here.

The Bottom Line

It can cause you a lot of financial stress and worry if you see your credit scores drop. But once you check the six core reasons why your credit score may have dropped, you can take the necessary action to begin to improve your scores. Whether you decided to set up a direct debit to ensure you never miss a payment or if you try to be more conscious of how many credit accounts you apply for, you can ensure no sudden drops in the future.

To support your journey to a new and improved credit score, you can always start today with MyMarble Premium. Check your credit score, read your credit report and learn exactly how to improve your scores with personalized recommendations. Sign-Up here.